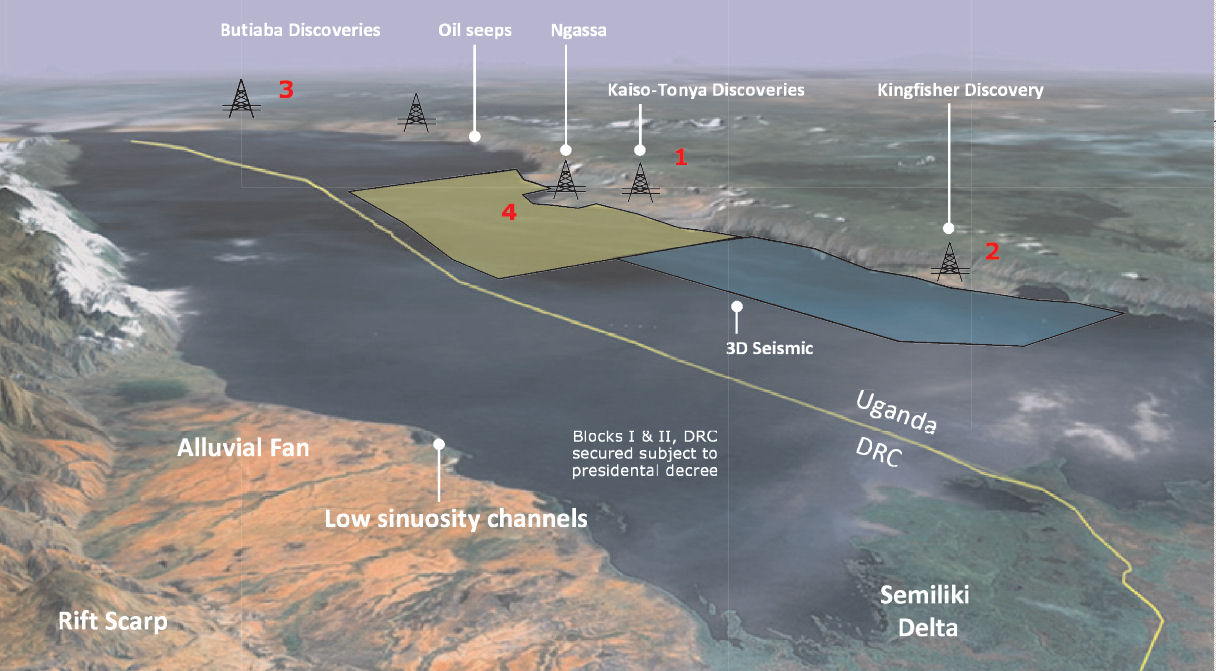

Tullow Oil, one of the two main companies exploring oil in Ugandaannounced last week yet another promising find- likely to support its arguments that Uganda should postpone its early production scheme [EPS] and focus on a large plant in the future. The company and government have shelved plans for producing light and heavy diesel as well as kerosene from a small production unit which was meant to start this year. However both company and government sources have said there needs to be consensus on whether Uganda should refine its oil here or export it as crude before a decision is taken. Tullow has also argued that rather than invest in a small plant for early production the government is better advised to put its money to use on an appropriately sized plant that takes into account the full extent of its oil assets. “ Uganda wants a refinery and that’s non-negotiable” said Hon. Steven Mukitale [Buliisa MP] who chairs the natural resources committee and sits on the committee on natural resources. In an interview yesterday Mukitale said while the debate continues on what framework best supports Uganda’s desire to refine its own oil it was no longer debatable that the country had enough reserves to support a large refinery. “ These discoveries of over 2 billion barrels of oil will no doubt help reassure financiers” he said. On its website last week Tullow said fresh discoveries at Nsoga 1 Exploration Well give a green light that other wells planned in the Butiaba area will continue the trend of successes the company has encountered. “This successful drilling de-risks other nearby prospects which are scheduled for drilling later this year” said Augus McCoss, the company’s director for exploration. Earlier this year Brian Glover Tullow’s country manager told Daily Monitor the company’s planning was meant to “increase production capacity” on the back of irreversible success in oil discoveries. Current estimates for revenues from Uganda’s oil discoveries once they go commercial are approximately 2 to 5 billion dollars annually- according to Tullow, several times the country’s export earnings. However until a resolution on whether or not to refine Ugandan oil locally or export it crude is arrived at- future realities are bound to remain just that say industry sources. Government and company officials are looking at current market conditions including the price of oil and cost of borrowed money. One of the issues being problematised is whether Tullow and other exploration companies will sell their interest to larger firms capable of raising cash to invest in refining capacity locally. Tullow according to the Irish financial press has already snubbed an approach from giant state supported Chinese oil companies.

submitted to the Daily Monitor