The East African rift valley is like a mother with her warms stretched out. In 2006, she opened her left hand to reveal a jewel. By the Albertine rift, hidden partly in the depths of the lake and within the arteries of the Nile nestled like strings on her palm was oil in Uganda. In 2012, six years later she opened her other hand. Along the gnarled aridness of the Turkana valley, she revealed once again she had another jewel. More oil.

Just below her navel, in Northern Tanzania gold had already been discovered. Like shimmering waist beads, her suitors now ponder what other treasures are hidden. The announcement by Tullow 48 hours ago that oil was discovered in Kenya is a real game changer not just for East Africa’s largest economy but for her other siblings.

In particular it will have a profound impact on how we think of oil extraction anywhere else in the world. Here is why. Oil (gold and other riches but mainly oil) discovered in the region comes at a time when its political and economic integration present themselves as the single most important strand of state-building here.

When Uganda announced commercial quantities of oil it was an East African exception. Both Kenya and Tanzania doubled their efforts but until this week it seemed like Uganda was alone. With Kenya’s discovery many things must be rethought, maps taken out, friends and partners re-assured.

Kenya is not just a country with a port, an existing refinery and oil pipeline infrastructure heading east towards Uganda; it recently committed 27 billion dollars to advancing its petroleum evacuation stock with new pipelines, airports and a new port in Lamu targeting oil from South Sudan. Most importantly Kenya marches to First Oil with stronger public institutions more capable at running large-scale projects than it’s neighbors especially Tanzania and Uganda. If oil had been discovered in Rwanda ( there is some attempt in the Kivus), perhaps this may have been something else.

The Tullow discovery, if commercially viable, shall put Nairobi at the head of the table as a first among equals. There are immediate implications for Uganda where senior government officials are revisiting their scenarios for frog marching into a future with oil. To put it in perspective, Uganda now has to compete with Kenya for investment dollars and attempt to keep her momentum as the first off the block. However since Kenya will be a safer bet for capital from the free markets, Uganda may need to look seriously at sovereign wealth funds to make her fields competitive. Kampala intends to supply oil products from a refinery in the hinterland. It can still do so but its unlikely to raise money for it from the open market quickly enough if refining in Kenya remains the logical option.

The oil consortium including Tullow oil, Total of France and CNOOC will also have to revisit their own plans. As Kenya announced its find their joint operating agreements which need pre-approval by the Ugandan government were reportedly delayed after the government raised issues with them. The companies may not look at future delays as a bad thing as attention turns to Turkana. It has been the case that as a monopoly of sorts, Uganda’s status has given it great bargaining ground especially for its highly centralized decision making system centered on the Presidency.

Now investors can look to a more devolved environment next door in Kenya where political liberalism and public accountability have become fashionable following a recent constitutional makeover. If Uganda’s illiberal oil sector has given it advantage over the oil companies, Kenya’s more liberal institutions may offer faster resolution of hurdles and the expectation that oil will reach the market faster for some of the reasons cited above.

This contradiction of illiberalism versus its opposite is an important one for East Africa and especially Uganda.

One way to think about the oil finds is within the framework of the East African Community, which is an ambitious effort at political integration as well. In this view, Kenya and Uganda’s assets are but one whole. Kenya’s advantages then argument Uganda’s own, presenting a single basket for investment. However this is the more difficult scenario to contemplate in the short term.

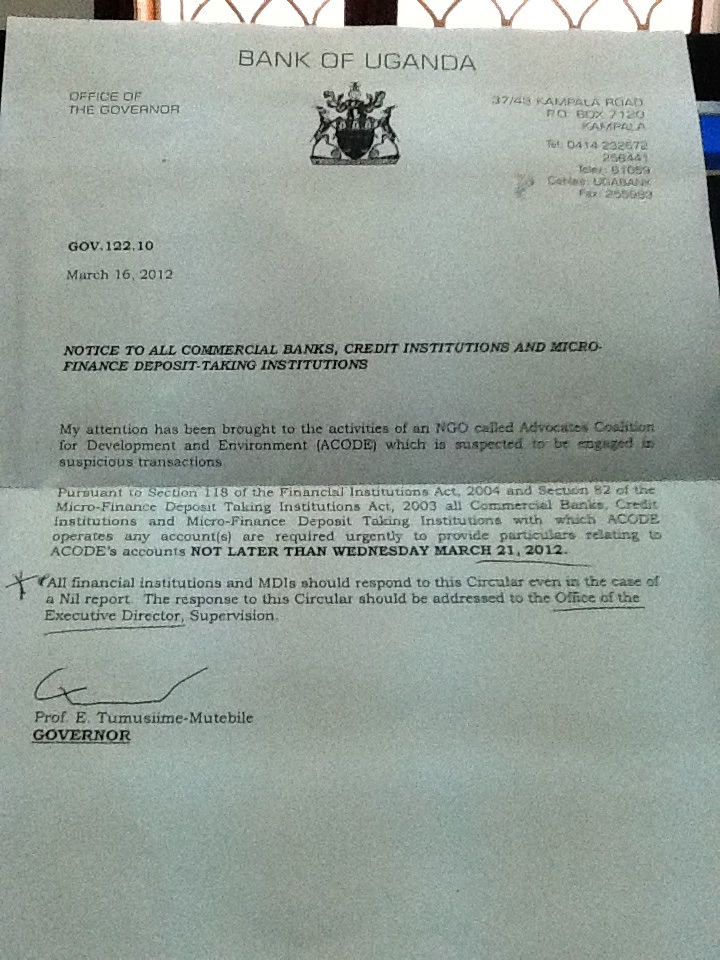

Last week one of the largest NGO’s in Uganda, ACODE, and one that is leading a robust oil governance advocacy team of other non-government groups heard that the country’s Central Bank had “subpoenaed” its accounts in an unusual letter to all commercial banks.