Uganda is struggling to find a decent partner for its oil refinery project in Hoima. This project is the hallmark of the country’s approach to its petroleum resources. Since oil was discovered in commercial quantities – there has been a fork in the road for investors keen to take part in exploiting the resource but nervous about the political risk of long term partnership with the Ugandan authorities.

The government however held out on a refinery – and made it a precondition for any crude commercialization. Currently the search for a refinery partner has not lost its fragility even if arrangements for a crude export pipeline have been agreed upon. Last we checked after the exit of the Russian conglomerate –Rostec, and the indifference of South Korea’s SK industries (which was a runner-up to the initial refinery bid process), a handful of “ speculating” companies have been meeting with the government side. The process is less public now.

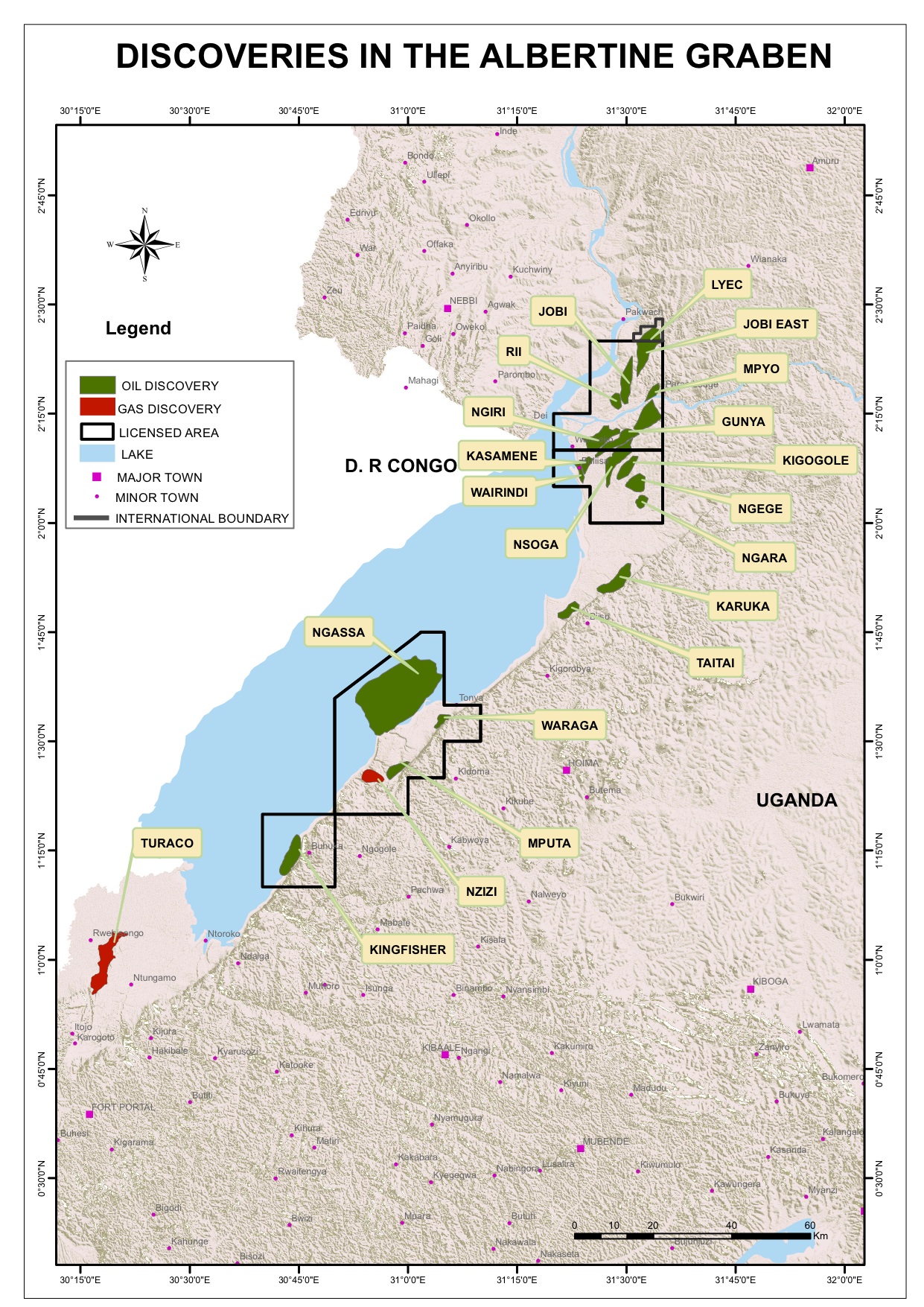

The most prominent of these companies is the Chinese firm CNOOC – which got the first commercial licence in Uganda in 2013. The company is in partnership with UK’s Tullow Oil and France’s Total EPC. It has not done anything with the license itself and it is not clear if it will commit to investing in the refinery.

It also has a real grasp of the Ugandan decision-making process. Chinese companies are dominant in the energy sector including CNOOC’s sister firms like SynoHydro which is building the Karuma Dam – Uganda’s biggest public infrastructure project yet. Its engagement in the refinery will signal willingness to tough it out in the increasingly hostile relationship between Chinese investment and Ugandan bureaucrats. But perhaps it is drawn by the government re-evaluation of its position on the refinery – one, which I supported since the project, was a proposal within the Ministries of finance and energy in 2007.

This position is that the Ugandan refinery needs to be a purely public investment – at least as much as possible. The real value of the project is in the public goods and opportunities it can offer after several years – of likely subsidized operations. These include the lighting of border towns along the Uganda-Congo-Rwanda borders and in West Nile, the provision of affordable kerosene to homesteads in that belt – already straining the wood resources there, and finally the activation of a regional market for petroleum products including diesel and other lubricants. In other words the refinery economy is domestic and strategically so. To hinge its viability on investment from elsewhere is to commit to it only partially for the money it can bring to the Treasury.

That said, the manner in which the bidding process was handled, the picking of Rostec and the stumbling about now, suggests that at the core the government has not, despite its desire for a refinery-led petroleum sector, put its money where its mouth is. Investors can see this and will probably bleed the patience of the government until domestic resources are committed to the project in the majority.

In last week’s parade of companies many were looking to act as commission agents for further investment. Not surprisingly given the nature and cost of the project – even with 40 per cent stake by the national government. They include the following in the initial list, besides CNOOC; Yantra Ventures (USA), SARAS SPA from Italy, GuangZhou Dongsong Energy Group (China), Marubeni Corporation of Japan and Burj Petroleum, an Abu Dhabi based firm. Others are Drop-In-BioEnergy and a Canadian firm AmCabana. Technocrats and politicians in Uganda are holding out to the hope that a credible and committed partner will emerge and are expanding the search. However it will eventually be obvious, in my view, that the refinery financial arrangements involve public funds in the majority and a program to engage local investors.